child tax credit portal

IR-2021-235 November 23 2021. The widget was created for low-income families those earning less than 12400 individually and 24800 for couples who arent required to file a tax return but can still claim.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

To sign up with the IRS non-tax-filers will need to submit their.

. Sign in to your account You can also refer to Letter 6419. You can use it now to view your payment. The amount you can get depends on how many children youve got and whether youre.

The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can receive their monthly Child Tax Credit. So that they can get some more benefits by paying IRS Tax. Join The Millions Who File Smarter And Get Your Taxes Done Right Guaranteed.

The Child Tax Credit Update Portal allows users to make sure they are registered to receive advance payments. On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families. Our child tax credit calculator tells you how much money you might receive in advance monthly payments in 2021 and how much of the credit youll claim when you file your.

Already claiming Child Tax Credit. Ad Get Your Maximum Refund Guaranteed Even If Youve Received The Advance Child Tax Credit. Ad The new advance Child Tax Credit is based on your previously filed tax return.

You should use the Child Tax Credit Update Portal CTC UP on the IRS website to let the IRS know about changes to your situation. 3600 per child under 6 years old. Child Tax Credit Portal is started by IRS for taxpayers.

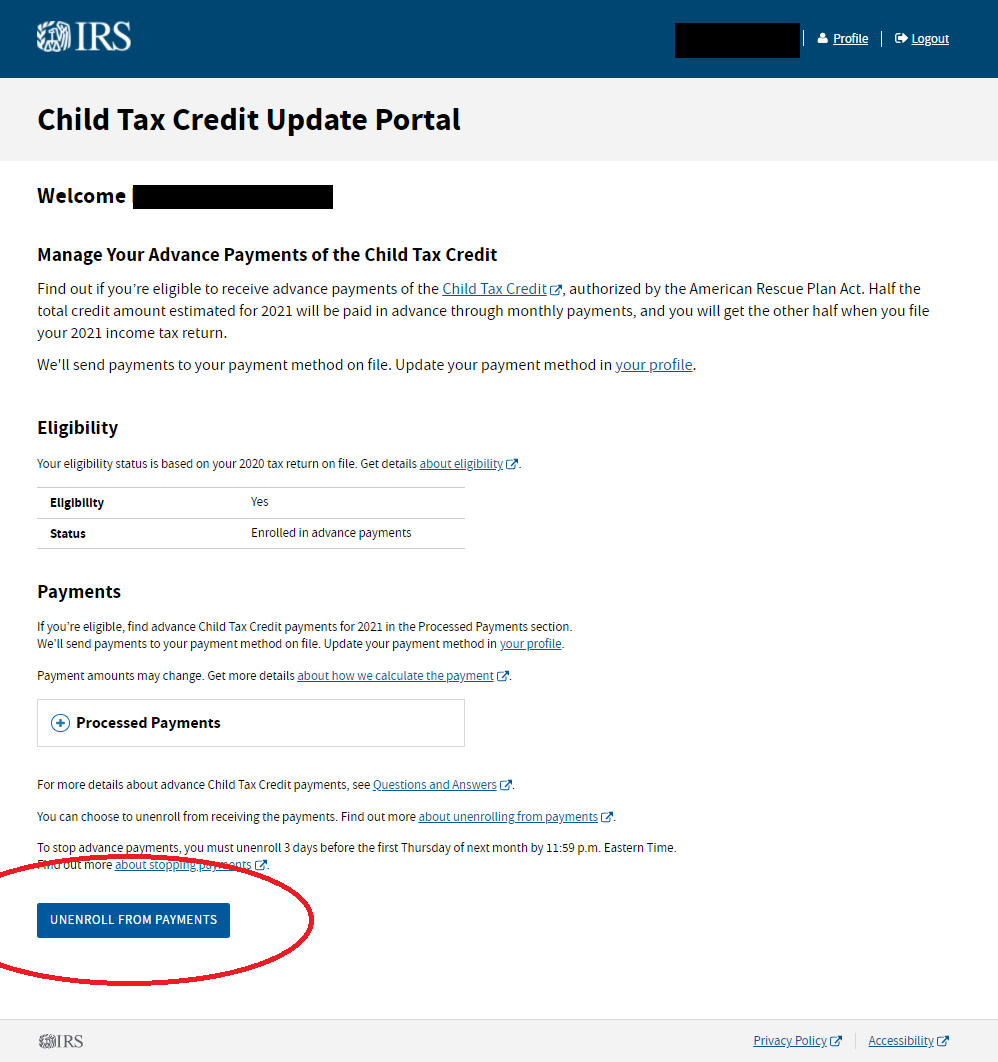

It also lets recipients opt out of advance payments in favor of a one. This tool can be used with your cell phone. You can use your username and password for the Child Tax Credit Update Portal to sign in to your online account.

The advance is 50 of your child tax credit with the rest claimed on next years return. The Child Tax Credit Update Portal allows you to verify your eligibility for the payments. Thanks to the new IRS portal non-filers can register for the Child Tax Credit online.

Visit the IRS website to access the Child Tax Credit Update Portal Go to httpswwwirsgovcredits-deductionschild-tax-credit-update-portal. You can also use the tool to unenroll from receiving the monthly. Full name Mailing address Email.

Click the blue Manage. The IRS is updating the CTC Update Portal over time. June 28 2021.

You can use the IRS Child Tax Credit Update Portal to view. The Child Tax Credit Update Portal has been updated to allow families to update their direct deposit information or to unenroll from receiving advance payments for the child. Making a new claim for Child Tax Credit.

This section will help you identify Child Tax Credit payments you have received and tell the difference from other tax benefits. Thats because certain information provided by the CTC portal could be out of date. Does anyone elses child tax credit portal say pending eligibility.

WASHINGTON The Internal Revenue Service this week launched a new Spanish-language version of the Child Tax Credit Update Portal CTC. In the same boat. The IRS says 35 million families have received child credit tax payments worth 15 billion.

The American Rescue Plan Act increased child tax credit payments so that families will receive 3600 per child under age six and 3000 per child from age 6 to 17. You can find the advance child tax credit payment information you need to file your 2021 tax. Simplified Tax Filing to Claim Your Child Tax Credit.

Families can use Child Tax Credit CTC Portal to check. 3000 per child 6-17 years old. The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving any payments in 2021.

Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child. All working families will get the full credit if they make up to 150000 for a couple or 112500 for a family with a single.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Portal Irs Warns Of Wrong Amounts Here S What You Should Do Gobankingrates

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

What Families Need To Know About The Ctc In 2022 Clasp

Childctc The Child Tax Credit The White House

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit 2021 Payments To Be Disbursed Starting July 15 Here S When The Money Will Land Cbs News